By Kamal Ahmed and Lawrie Holmes 1005PM GMT twenty March 2010

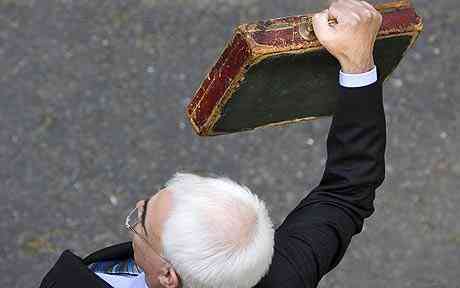

Alistair Darling clutches a formally smashed red box

Alistair Darling clutches a formally smashed red box The new taxation will be the centre square of Alistair Darling"s Budget on Wednesday with any income lifted being returned to the Government. It will often affect investment promissory note operations and will leave "vanilla" sell promissory note to go on underneath the taxation complement of administration they now face.

Although the Treasury pronounced it had nonetheless to have an guess how most income the new taxation would move in, it could well be tens of billions of pounds.

Why the taxation complement deters trailblazers Labour"s last embankment bill Pre-Budget inform MPs to hold puncture discuss City bonuses are being saved by a secrecy taxation on assets Nationwide increase tumble on astray FSCS levy Budget 2009 The Government should postpone residential stamp avocation utterlyThe new taxation will not be an "insurance fund" for the promissory note industry, as ministers are endangered that such a magnitude would simply inspire some-more unsure poise of the sort that led to the monetary predicament of 2008. Instead fortitude agreements (also well known as vital wills) will meant banks will be forced to mangle up should they ever destroy again.

"We do not see the point of formulating a mega-fund to hope for for an additional promissory note failure," pronounced one well-placed source. "We do think that where people are formulating risk for the taxation payer they should be taxed accordingly. "It will be identical to wickedness taxes on industry to daunt repairs to the environment."

The International Monetary Fund will inform subsequent month on how the tellurian village should reply to the need to lift out systemic risk in the monetary system. It is believed that Dominique Strauss-Kahn, head of the IMF, will broadly acquire plans for additional taxes on banking"s riskier activities.

Treasury officials pronounced that Britain would not "go it alone" on the new tax, and that it was expected there would be agreement on identical taxation regimes opposite the world.

The headlines comes after David Cameron, the personality of the Opposition, voiced that the Conservatives would be peaceful to action unilaterally on an general promissory note taxation if there was no tellurian agreement.

Tory sources said, though, it was doubtful they would have to, since signals from the G20. President Obama has pronounced that he supports new levies on promissory note in America.

The UK promissory note run has warned that any taxation on banks contingency not criticise attempts to cure the economy.

Responding to Mr Cameron"s debate yesterday, a orator for the British Bankers" Association pronounced "UK banks have already done changes to how they are structured and the volume of collateral and money they hold to assistance forestall any destiny problems.

"We hold any serve reforms need to be timely, deliberate and internationally mutual so they do not shorten credit to people and businesses as liberation picks up speed.

"Taxpayer involvement to brace the UK promissory note industry is on lane to be paid back. And we will work with everybody on issues around a last-resort involvement account as well as alternative equates to to strengthen the taxpayer should a complaint movement in the future.But UK banks hold the most appropriate march is to wait for for the result of subsequent month"s IMF proposals."

Mr Cameron voiced the measures whilst vocalization to supporters in Putney, south-west London.

He pronounced "This is no time to bashful afar from opposed a little of the greatest vested interests in the nation the banks. We had the greatest bank bail-out in the world. We can"t only lift on as if zero happened."

Referring to President Obama"s plans to redeem supports used to bail out US banks, he pronounced "Why should it be any opposite here? A Conservative supervision will deliver a new bank levy to compensate behind taxation payers and to strengthen them in the future.

"It won"t be renouned in each piece of the City. But I hold it"s satisfactory and it"s necessary."

0 comments:

Post a Comment